Comments by Brian Shilhavy

Editor, Health Impact News

I am publishing this on the evening of November 9, 2022. The DOW ended down -646.89 and the NASDAQ ended down -263.02 today, and yet in the corporate news the headlines are all still about the mid-term elections, as this news about the fall of FTX is still developing.

What will the markets do tomorrow, when all these lost BILLIONS of dollars sink in with investors on Wall Street?

The October Consumer Price Index (CPI) report is also due tomorrow, and if it bears bad news about inflation, we could see a bloodbath in the markets tomorrow (Thursday November 10, 2022).

UPDATE 11/10/22: CPI came in lower than expected, so the stock market, which has become nothing more than an extension of gambling that happens in Vegas, is higher this morning, not because inflation is easing, but because it did not increase as much as expected in October. So until all this fiat money created by the Fed disappears like the crypto “money” did this week, the gambling continues…

Now that the world’s largest crypto exchange, Binance, has walked away from a bailout of world’s second-largest crypto exchange, FTX, but biggest ever crypto fraud – far bigger than MtGOX ever was, here is a list of all the “luminary” investors whose money in FTX is now gone… all gone.

We start at the top, where we find the “who is who” of clueless momentum chasers, who over the years somehow got confused with credible, diligent investors: we are talking of course about Tiger Global, which is down 55% this year (and is about to be down a whole lot more) and of course the fund that we once dubbed the bubble era’s “short of the century“, SoftBank.

Can't make this up: among the January Series C investors in FTX which valued the ponzi scheme at $32BN, were Tiger Global (down 55% YTD) and Softbank

— zerohedge (@zerohedge) November 9, 2022

One wonders how much of today’s widespread selling across various asset classes was due to Tiger Global getting margin called and dumping what it can?

There are more funds, of course: Third Point and Altimeter Capital Management are among hedge funds that recently participated in funding rounds for Sam Bankman-Fried’s once-high-flying crypto exchange. Brevan Howard Asset Management’s Alan Howard, the family office of Paul Tudor Jones and Millennium Management founder Izzy Englander also chipped in as angel investors, alongside celebrities including Gisele Bundchen and Tom Brady.

There were many others: FTX also attracted capital from the Ontario Teachers’ Pension Plan, Sequoia Capital, Lightspeed Venture Partners, Iconiq Capital, Insight Partners, Thoma Bravo and Masayoshi Son’s SoftBank.

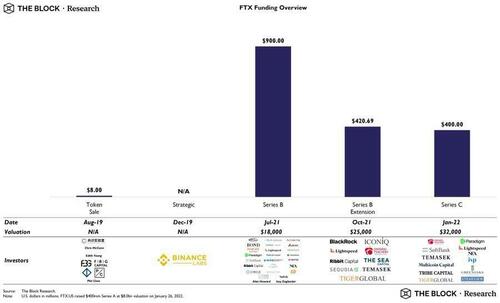

Tiger Global and Ontario Teachers’ first invested in FTX in December 2019 in a funding round that valued the company at $8 billion, according to PitchBook data. Both topped up their wagers in October 2021, giving FTX a $25 billion valuation, and did so again in January, the data show. Some of the other firms and individuals backed FTX in July 2021, paying cash to participate in a $1 billion funding round that valued the crypto exchange at $18 billion.

Prefer bullets? Here is a list of the most prominent investors in FTX courtesy of The Block’s Frank Chaparro:

- BlackRock

- Ontario Pension Fund

- Sequoia

- Paradigm

- Tiger Global

- SoftBank

- Circle

- Ribbit

- Alan Howard

- Multicoin

- VanEck

- Temasek

Remarkably, as ever more clueless pedigreed investors piled up to fund this fraud of epic proportions, the valuation went super parabolic, and after two early rounds in 2019 and 2020, FTX got its first real outside funding in July 2021 when it pocketed $900MM at a valuation of $18 billion in its Series B round; this was followed by two more rounds, the most notable of which was Series C when ts valuation exploded to a staggering $32 billion. It was around this time that Scam Bankrupt-Fraud started naming sports stadiums, and imagined a world in which FTX would buy Goldman.

The chart below is the definitive proof that even (or rather especially) the smartest investor do no homework before allocating huge amounts of capital.

All that seems so long ago now that regulators are investigating whether FTX properly handled customer funds – translation: the firm probably used client funds from its exchange to funds its trading shop, Alameda Research – and the firm’s relationship with other entities Bankman-Fried controls, and concerns raised by Binance executives during their due diligence process could torpedo the deal.

As a result of FTX collapse, all of the abovenamed investors, among others, are set to lose all of their invested cash, especially with news such as this hitting the tape:

- *BANKMAN-FRIED TOLD INVESTORS FTX HAS SHORTFALL OF UP TO $8 BLN

Still, while billions will be lost, nobody will be crushed as much as Bankman-Fried himself, whose personal wealth has collapsed from $16 billion to what may now be a negative number when accounting for his personal debt. Of course, it’s all downhill from there especially once SBF is thrown in prison from stealing billions in client funds in his exchange and using them not even to buy yachts but to make catastrophically bad investments.

Read the full article at ZeroHedge News.

Comment on this article at HealthImpactNews.com.

This article was written by Human Superior Intelligence (HSI)

See Also:

Understand the Times We are Currently Living Through

New FREE eBook! Restoring the Foundation of New Testament Faith in Jesus Christ – by Brian Shilhavy

Who are God’s “Chosen People”?

KABBALAH: The Anti-Christ Religion of Satan that Controls the World Today

Christian Teaching on Sex and Marriage vs. The Actual Biblical Teaching

Exposing the Christian Zionism Cult

The Bewitching of America with the Evil Eye and the Mark of the Beast

Jesus Christ’s Opposition to the Jewish State: Lessons for Today

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

What is the Condition of Your Heart? The Superiority of the Human Heart over the Human Brain

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Image of the Beast?

Medicine: Idolatry in the Twenty First Century – 10-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

Leaving a lucrative career as a nephrologist (kidney doctor), Dr. Suzanne Humphries is now free to actually help cure people.

In this autobiography she explains why good doctors are constrained within the current corrupt medical system from practicing real, ethical medicine.

One of the sane voices when it comes to examining the science behind modern-day vaccines, no pro-vaccine extremist doctors have ever dared to debate her in public.

-

Book – The Vaccine Court, by Wayne Rohde – 240 pages

“The Dark Truth of America’s Vaccine Injury Compensation Program”

FREE Shipping Available!

ORDER HERE!