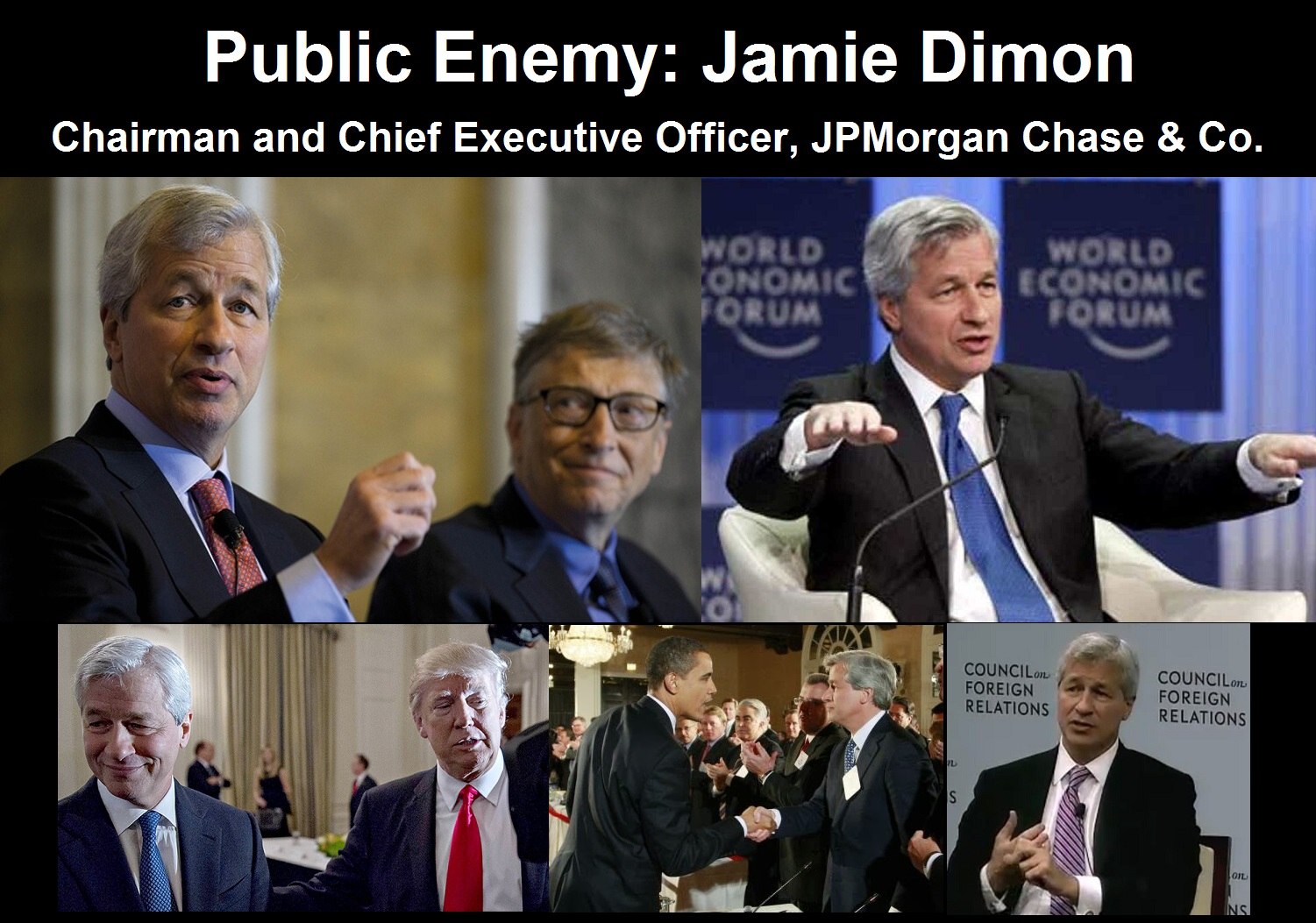

Jamie Dimon with Bill Gates image source, Jamie Dimon World Economic Forum image source, Jamie Dimon with President Trump image source, Jamie Dimon with President Obama image source, Jamie Dimon Council on Foreign Relations image source.

There Are Three Separate Cases in Federal Court Accusing JPMorgan Chase of a Culture of Fraud

by Pam and Russ Martens

Wall Street on Parade

JPMorgan Chase is the largest federally-insured bank in the United States. It is also one of the largest trading houses on Wall Street. That’s the Faustian bargain the Clinton administration entered into with Wall Street when it repealed the Glass-Steagall Act in 1999.

According to data from the FDIC, as of June 30 of last year, JPMorgan Chase Bank N.A. had 4,925 branches in 44 U.S. states holding $2.01 trillion in deposits. Many of those deposits belong to mom and pop savers who have no idea that the bank has admitted to five criminal felony counts since 2014 and has a rap sheet that is the envy of the Gambino crime family. (Apparently, a federal judge in New York overseeing a current JPMorgan case is just as naïve about the bank’s criminal history. More on that shortly.)

The bulk of Americans also do not know that neither federal regulators nor Congress nor the Board of Directors of JPMorgan Chase have demanded that the Chairman and CEO of JPMorgan Chase, Jamie Dimon, who has sat at the helm of the bank throughout this crime spree, be sacked. Dimon’s tenure has been propped up by a public relations machine and an obsequious mainstream media. (See here and here.)

Corruption of this magnitude can’t be swept under the rug forever, however. Today, three cases are playing out simultaneously in federal courts. Observed together, which no member of mainstream media is currently doing, they paint an undeniable picture of a bank which, as Senator Bernie Sanders would say, has adopted fraud as a profitable business model.

Let’s start with the case known as U.S. v. Smith playing out in the federal District Court for the Northern District of Illinois in Chicago. (Case number 1:19-cr-00669.) Federal prosecutors from the Justice Department have charged multiple traders on the precious metals desk of JPMorgan Chase with turning the trading desk into a racketeering enterprise from 2008 to 2016.

For the first time that veterans on Wall Street can remember, the Justice Department is using the RICO statute, typically reserved for members of organized crime, to charge JPMorgan’s traders. (The bank settled its own charges in September 2020 and paid $920 million in fines – a mere pittance in terms of the profits that were likely made on these “tens of thousands” of trades over a period of eight years.)

Making the situation extremely dicey for both the indicted traders and the bank’s reputation, federal prosecutors have called to testify two former precious metals traders on that desk who have pleaded guilty to related charges and are cooperating with prosecutors. (A third cooperating witness is expected to testify.)

One of those cooperating witnesses, John Edmonds, told jurors that “Our job was to do whatever it takes to make money” and “Everyone at the time did it on the desk and it worked.” When asked why he didn’t report the conduct to the compliance officers at the bank, Edmonds responded that “I would have been fired.”

This certainly suggests that he felt fraud was not just a standard practice at the bank but was an enshrined profit-making strategy.

Another cooperating witness, Corey Flaum, told jurors that the practice of manipulating precious metal prices (spoofing) was done out in the open and was “common practice.”

While the indicted traders’ trial is playing out in Chicago, a trader on the precious metals desk who was not indicted for wrongdoing, Donald Turnbull, has brought charges against JPMorgan Chase in federal court in the Southern District of New York.

Turnbull alleges that the bank trumped up false charges against him as a pretext to terminate him when it was actually terminating him for cooperating with the Department of Justice’s investigation. Turnbull states in the lawsuit that the indicted traders received better benefits when they were released from employment than he did.

Despite a seriously-ill wife, Turnbull alleges in the lawsuit that JPMorgan Chase cancelled his health insurance, did not pay him severance, and took away his unvested stock awards.

Corrupt Judge? U.S. District Judge John Koeltl. Image source.

Despite the unprecedented crime history of this bank, the Judge overseeing this case, John Koeltl, has been pretty much giving lawyers from Big Law firm, Morgan Lewis, who are representing JPMorgan Chase, everything they ask for.

For example, Judge Koeltl dismissed Turnbull’s first amended complaint on a motion to dismiss by Morgan Lewis on the basis that he found it “implausible” that the bank would retaliate against Turnbull for cooperating with the Justice Department when the bank itself was cooperating with the Justice Department.

Either the Judge is feigning naivete, engaging in willful blindness, or is actually ignorant of how JPMorgan actually “cooperates” with investigators and prosecutors. For example, JPMorgan Chase was smacked with two felony counts by the Justice Department in 2014 for its role in Bernie Madoff’s Ponzi scheme.

The bank told its regulators in the U.K. that it believed Madoff was running a Ponzi scheme but failed to “cooperate” as it was required to under law by reporting its concerns to U.S. prosecutors and also failed to report red flags about Madoff’s money laundering to the Financial Crimes Enforcement Network (FinCEN), a unit of the U.S. Treasury.

Then there was the 300-page report from the Senate’s Permanent Subcommittee on Investigations on how JPMorgan Chase had used more than $100 billion of depositors’ money to gamble in derivatives in London and lose $6.2 billion. The Chair of that Subcommittee at the time, Senator Carl Levin, wrote that the bank “piled on risk, hid losses, disregarded risk limits, manipulated risk models, dodged oversight, and misinformed the public.”

If Senator Carl Levin were alive today, he would certainly not find it “implausible” that JPMorgan would retaliate against an employee cooperating with a criminal investigation. In fact, it was Senator Levin who introduced evidence in a hearing in 2014 showing that JPMorgan Chase had rushed to hire a person who had bragged on his resume that he knew how to game electric markets.

Turnbull now has a second amended complaint pending before Judge Koeltl’s court. Bizarrely, JPMorgan’s lawyers from Morgan Lewis asked Koeltl to redact paragraphs 67 through 70 of that complaint because the bank claims that those paragraphs contain information that is subject to attorney-client privilege from an interview it conducted with Turnbull.

But what actually happened was that the bank asked Turnbull to come and sit for an interview and explain what he knew about trading on the precious metals desk. He brought his own attorney. How that gives JPMorgan an attorney-client privilege with Turnbull should have raised red flags with a federal judge. It didn’t. The request was granted and paragraphs 67 through 70 are now a big, blacked out blob.

And in a perfect segue way, along comes the federal lawsuit brought by Shaquala Williams against JPMorgan Chase, also in the Southern District of New York under Judge Jed Rakoff.

Williams tells the court in her complaint that JPMorgan Chase did not fulfill its promise under a deferred prosecution agreement to cooperate with the Justice Department – something that Judge Koeltl in the Turnbull case finds “implausible” to believe.

Williams is a financial crimes compliance professional with more than a decade of experience at multiple global banks. Part of Williams’ role at JPMorgan Chase was to make sure that the bank was in compliance with a non-prosecution agreement the bank had signed with the Justice Department in 2016.

The Justice Department had charged in 2016 that JPMorgan’s Asia subsidiary had engaged in quid pro quo agreements with Chinese officials to obtain investment-banking business and had falsified internal documents to cover up the activities. The quid pro quo agreements resulted in the bank putting the children of high Chinese government officials on its payroll in order to further its business interests in China.

In exchange for avoiding prosecution, the Justice Department required JPMorgan to create compliance controls around third-party payments. Williams alleges, among numerous other serious charges, that the so-called third-party payment controls were a sham and that when she blew the whistle to her superiors at the bank, the bank retaliated against her by firing her in October 2019.

The case is Shaquala Williams v JPMorgan Chase, Case Number 1:21-cv-09326, which was filed last November. Very conveniently, Morgan Lewis is representing JPMorgan Chase in this case as well as in the Turnbull case.

Read the full article at Wall Street on Parade.

Comment on this article at HealthImpactNews.com.

Related:

Real Domestic Terrorists Need to be Tried for Treason and Genocide – U.S. Public vs. Corporate Bankers

See Also:

Understand the Times We are Currently Living Through

Exposing the Christian Zionism Cult

Jesus Would be Labeled as “Antisemitic” Today Because He Attacked the Jews and Warned His Followers About Their Evil Ways

Insider Exposes Freemasonry as the World’s Oldest Secret Religion and the Luciferian Plans for The New World Order

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

Who are the Children of Abraham?

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

Fact Check: “Christianity” and the Christian Religion is NOT Found in the Bible – The Person Jesus Christ Is

Christian Myths: The Bible does NOT Teach that it is Required for Believers in Jesus to “Join a Church”

Exposing Christian Myths: The Bible does NOT Teach that Believers Should Always Obey the Government

Was the U.S. Constitution Written to Protect “We the People” or “We the Globalists”? Were the Founding Fathers Godly Men or Servants of Satan?

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The United States and The Beast: A look at Revelation in Light of Current Events Since 2020

The Satanic Roots to Modern Medicine – The Mark of the Beast?

Medicine: Idolatry in the Twenty First Century – 8-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.

Leaving a lucrative career as a nephrologist (kidney doctor), Dr. Suzanne Humphries is now free to actually help cure people.

In this autobiography she explains why good doctors are constrained within the current corrupt medical system from practicing real, ethical medicine.

One of the sane voices when it comes to examining the science behind modern-day vaccines, no pro-vaccine extremist doctors have ever dared to debate her in public.

-

Book – The Vaccine Court, by Wayne Rohde – 240 pages

“The Dark Truth of America’s Vaccine Injury Compensation Program”

FREE Shipping Available!

ORDER HERE!