Commentary by Brian Shilhavy

Editor, Health Impact News

I want to start out this article by stating that I do NOT give out financial advice. I like to publish facts and information that may not be popular elsewhere, and I may sometimes allude to what I am doing regarding finances.

But there is no one-size-fits-all financial “truth” when it comes to managing one’s own finances or investing, and you should be wary of those who promote such one-size-fits-all views, and see if they have any economic motive for their “advice”.

How you manage your finances and invest depends on a variety of factors, including what it is you want to accomplish, and sometimes it is better to ignore financial advice from “the experts”, and use just plain old common sense.

I start from a thoroughly “prepper” mindset, as I have since 1998 when I started prepping for Y2K, and my goals and financial principles have been more refined from a “prepper mindset” since 2020 and the COVID Scam.

That means I am a financial pessimist, and believe that the entire system could collapse any day now, and I prepare accordingly.

In the event of a loss of infrastructure, where either electricity or the Internet, or both, become unavailable, one must understand how the economy will operate under such dire circumstances, and we actually have an example of that right now, and it has been going on for a few weeks now in Western North Carolina. See:

10,000 Body Bags Were Not Enough – Updates from on the Ground in North Carolina Disaster Relief

I personally know people from this area, and I have heard more than one of them report that during the days following the hurricane and their flooding rains that caused so much death and destruction, that local stores, such as gas stations, were ONLY accepting cash, and even there, only small bills (they would most likely not be able to exchange a 100 dollar bill, for example).

So if they could not even give change for a $100 bill, then they most certainly would not be interested in, or have the ability to, give you change on a 1 ounce gold coin or bar either, since the going rate is now over $2700 for spot price.

And that is assuming that those who are invested in Gold even have physical gold on hand that they can use, as the vast majority of people invested in Gold hold only “electronic gold”, meaning that to access it and retrieve it, they need BOTH electricity, and the Internet.

We know that the number of people purchasing physical gold is drastically increasing, since places like Costco and Walmart can barely keep physical 1 oz. gold bars in stock.

But I can almost guarantee that in a time of national crisis, which many believe could be imminent in this election year, you will not be able to go back to those same retail chains and be able to use your gold bars to be able to purchase anything in their stores (and in fact you cannot even do that right now).

So in times of emergency, as we are seeing in Western North Carolina, CASH is Gold, and real gold is useless there.

If you are worried about a cyber attack or real attacks on U.S. soil, you might want to consider cashing in some of your gold to hard cash, so that you have something to use for local purchases in case the Internet or power grid goes down for any length of time.

But having some cash on hand is only a temporary solution to use just after an emergency event. If essential services remain offline for any extended period of time, your cash will most likely become worthless, after the local businesses run out of the inventory of whatever product they are selling, as supply chains choke.

Then local communities will need to develop some sort of barter system for basic goods, and you will need either goods or services you can trade that have value in a barter system.

And that’s why I have chosen for myself, to invest in long-term storable food, healthy and uncontaminated food.

But even if the power grid and the Internet do not go down during a national crisis, there are other dangers for your financial assets, such as government confiscation.

Gold has been confiscated by the government in the U.S. in the past, and even today, have you ever tried to cash in any physical gold you own?

If you haven’t, you might want to look into it, because the U.S. government already requires anyone purchasing gold from someone else to report it to the IRS along with your name and personal info, over certain amounts (can vary by State).

If you don’t want the government to know about your personal gold sales over such limits that the IRS establishes, your options are few, and probably involves something like a local pawn shop giving you a lower rate, along with a suitcase of cash that is probably laundered money.

Getting involved in the criminal financial world is probably not something most honest Americans who have been convinced to invest in gold are wanting or willing to do (I know I’m not!).

Last week, ZeroHedge News published an excellent article about the many times throughout history governments have confiscated assets of private citizens:

Confiscation Games: Public Expropriation Of Private Assets

Some excerpts:

Executive Summary

Throughout history, governments around the world have occasionally resorted to confiscating the assets of their citizens in response to economic crises, political purges, or ideological pursuits. These actions, often justified as necessary for the greater good, have frequently resulted in widespread social disruption and significant hardship for the affected populations.

This report delves into four significant historical episodes of asset confiscation, examining the methods used by governments to seize property and the diverse strategies individuals and communities employed to resist or evade these confiscations. Each case provides insight into the complex relationship between state power and personal property rights, as well as the resilience of the human spirit in the face of adversity.

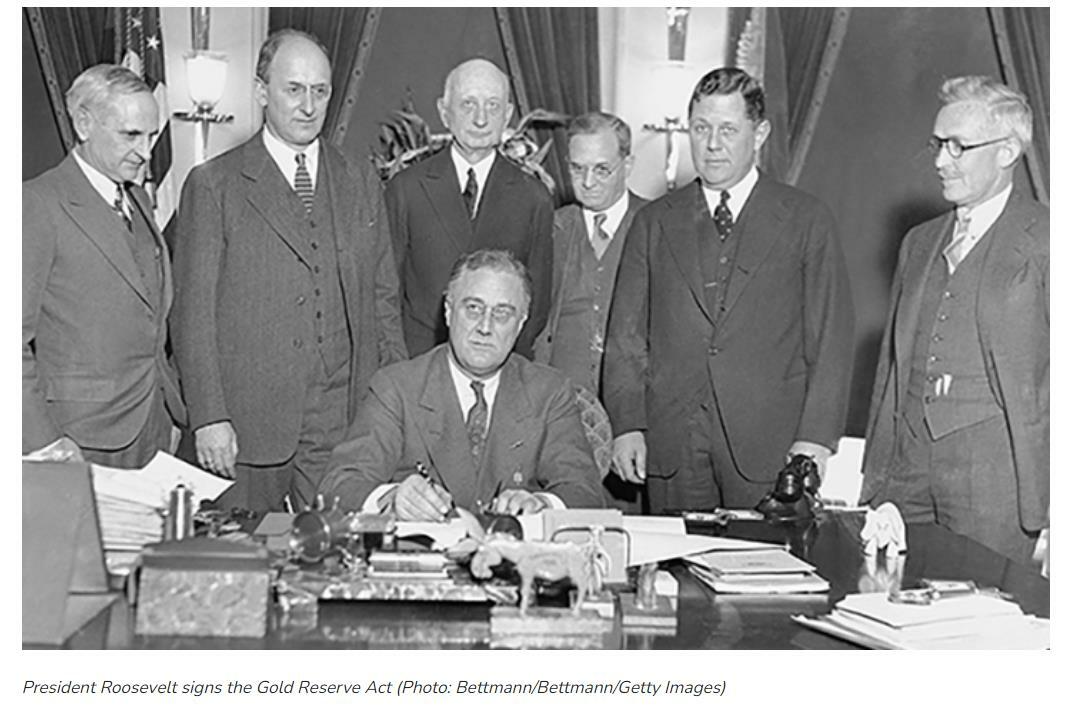

The Confiscation of Gold by the United States Government (1933)

The onset of the Great Depression in 1929 plunged the United States into a severe economic crisis unparalleled in its history. The stock market crash not only shattered the financial system but also led to catastrophic levels of unemployment, countless bankruptcies, and widespread despair. As banks collapsed and businesses shuttered, the American public grappled with unprecedented hardship.

By 1933, the economic situation had grown even more dire, with no sector of the economy untouched. Into this bleak landscape stepped Franklin D. Roosevelt, inaugurated as President in March of that year, bringing with him a new vision aimed at rescuing the nation from its economic plight.

Roosevelt’s New Deal was a series of programs and policies designed to revive the economy and restore confidence among the American people.

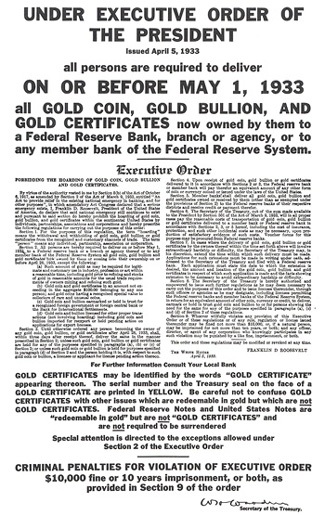

Among these initiatives, the decision to confiscate gold under Executive Order 6102 in April 1933 stands out as particularly bold and contentious.

This executive order mandated that all persons, businesses, and institutions within the United States surrender their gold coins, bullion, and certificates to the Federal Reserve, receiving in return paper currency valued at $20.67 per troy ounce.

Roosevelt’s rationale for such a drastic measure was rooted in the belief that hoarding gold was exacerbating the economic downturn. By hoarding gold, he believed that individuals were limiting the money supply available, which in turn deepened the deflation that was strangling economic growth.

The move to confiscate gold was aimed directly at undermining the gold standard, a monetary system in which the value of national currencies was directly linked to specific amounts of gold.

This standard restricted the Federal Reserve’s ability to increase the money supply during economic downturns, thereby limiting its ability to stimulate economic activity.

By removing gold from private hands and centralizing it within the Federal Reserve, Roosevelt hoped to expand the money supply and thus combat the crippling deflation.

The following year, Roosevelt pushed forward with the Gold Reserve Act of 1934, which not only reaffirmed the government’s control over all gold but also increased the official price of gold from $20.67 to $35 per ounce.

This significant devaluation of the dollar sought to boost economic recovery by making American goods cheaper on the international market, thus increasing exports and reducing the balance of trade deficit.

The government enforced these new policies with stringent penalties, threatening violators with hefty fines and imprisonment, signaling a stern commitment to these drastic measures.

Public reactions to these gold policies were deeply divided. While many Americans complied with the order, either out of a sense of national duty or resignation to the economic emergency, a significant number resisted, driven by a combination of distrust in the government and a determination to safeguard personal wealth.

Resistance took many forms. Individuals went to great lengths to hide their gold, employing creative methods to evade confiscation. Gold was buried in backyards, secreted away in hidden compartments of homes, or transformed into innocuous items like jewelry or art.

Others exploited loopholes in the legislation, particularly the exemptions that allowed professionals like dentists, jewelers, and artists to retain necessary gold for their work. Some claimed these professional exemptions under dubious pretenses, while others rushed to invest in numismatic coins—rare and collectible coins that were initially exempt from confiscation.

The affluent and certain businesses looked beyond American borders, moving their gold assets to international banks or engaging in elaborate foreign transactions to protect their holdings.

As government scrutiny intensified, a black market for gold flourished, allowing covert trading and providing an avenue for transactions that circumvented official channels. In certain areas, barter systems emerged where gold acted as a medium of exchange, further undermining the government’s attempts to control the currency.

The long-term consequences of Roosevelt’s gold policies were profound and multi-faceted.

Economically, these measures provided the necessary liquidity to tackle deflation, facilitating a gradual recovery from the Depression. The increased money supply resulting from the devaluation of the dollar and the abandonment of the gold standard allowed for greater flexibility in monetary policy.

This adaptability was crucial not only during the remaining years of the Depression but also in shaping the economic strategies of subsequent decades.

The revaluation of gold and the shift away from a strict gold standard also laid the groundwork for the Bretton Woods system, which established the U.S. dollar as the backbone of the international financial system after World War II. This system played a pivotal role in global economic stabilization until its dissolution in the early 1970s.

The episode remains a potent symbol in discussions about government overreach and economic liberty, shaping the ideological debates that continue to influence American political and economic thought.

In retrospect, the U.S. government’s intervention in the gold market during the Great Depression was a watershed moment with lasting impacts. While it played a crucial role in addressing the immediate economic crisis and reshaping U.S. monetary policy, it also left a legacy of wariness about government power over personal assets.

These actions and their repercussions continue to echo through the financial markets and shape government policies, reminding us of the delicate balance between necessary economic intervention and the protection of individual freedoms. (Full article.)

Is Cryptocurrency the Answer to Avoiding Government Confiscation?

The first thing that should be obvious when discussing any cryptocurrencies, is that just like “digital gold,” the ability to use and trade any cryptocurrency is 100% dependent upon the Internet and power grid, and if either goes down, your cryptocurrency is worthless during those times.

And if you store your cryptocurrencies online, they can be confiscated, as we saw back in 2022 when Coinbase seized 25,000 accounts (wallets) owned by Russian citizens. See:

Crypto Currency WARNING! Coinbase Cuts Off 25K Russian Wallets!

In the financial world today, there is an apparent war going on, mostly behind the scenes, between traditional bankers and their Central Banks, and the Fintech world, with Silicon Valley’s love affair with cryptocurrencies.

MicroStrategy founder Michael Saylor made waves this week in cryptoland, when he suggested that crypto users should store their assets in Too-Big-to-Fail mega-banks.

Saylor’s Comments On Bitcoin Custody Are “Batshit Insane”

MicroStrategy founder Michael Saylor’s suggestion that crypto users should use big banks to custody Bitcoin is “batshit insane,” Ethereum co-founder Vitalik Buterin said, adding to a growing backlash from the crypto community.

“I’ll happily say that I think Saylor’s comments are batshit insane,” said Buterin in response to an Oct. 22 post on X from Bitcoin custody firm Casa’s chief security officer and cypherpunk Jameson Lopp, who was extolling the virtues of self-custody.

It’s the latest criticism aimed at MicroStrategy’s Saylor after he suggested on Oct. 21 that Bitcoin holders should rely on “too big to fail” banks that are “engineered to be custodians of financial assets” – an apparent U-turn on his previous comments about self-custody.

Buterin said Saylor appeared to be “explicitly arguing for a regulatory capture approach to protecting crypto,” such as investment managers BlackRock and Fidelity holding the asset with “all the lawmakers and law enforcement arms invested in those entities.”

“There’s plenty of precedent for how this strategy can fail, and for me, it’s not what crypto is about.”

Saylor also called out “crypto-anarchists” during the interview with financial markets reporter Madison Reidy, warning that non-regulated entities that don’t acknowledge government, taxes or reporting requirements will increase the risk of the asset’s seizure. (Source.)

Another news story that came out this week that gives further evidence that there may be a mostly behind-the-scenes war with traditional banks and Fintech financial institutions, is the report that Wells Fargo, the third largest bank in the U.S., stopped working with some of largest Fintech names in the business, including PayPal, originally founded by Elon Musk, Peter Thiel, and the rest of the PayPal mafia.

Bank Drama for PayPal, Square After Wells Fargo Bows Out

For more than two decades, Wells Fargo was a juggernaut in a behind-the-scenes business that supported some of the biggest payments companies in the world. The bank’s abrupt exit from that market this year has left a major hole.

Block’s Square, for instance, is still hunting for a replacement for Wells Fargo to work on credit card transactions, according to people familiar with the relationship. Square also works with JPMorgan Chase, but it needs a second bank as a backup to avoid service disruptions. And banks have different appetites for the types of transactions they’re willing to process.

The fintech sector is facing an existential threat: It’s become riskier and more expensive for banks to work with these businesses on behind-the-scenes services offering bank accounts, loans and payments services. Some small banks have pulled out of certain fintech services, causing disruptions, but a defection by Wells Fargo, the third-biggest U.S. bank, marks the highest-profile one yet.

Payments companies enjoyed early success by making it simple and fast for consumers and businesses to set up accounts and send and receive payments. Companies including PayPal, Square and Stripe piggyback off banks’ infrastructure and licenses to accept Visa and Mastercard payments through a business known in the industry as BIN sponsorship (BIN stands for bank identification number).

The exit of Wells Fargo from the BIN sponsorship business means payments firms have run the risk of potential outages and steeper costs. Block, for one, warned in its annual report earlier this year that its business would be “materially and adversely affected” if service providers like the so-called acquiring banks that accept card payments fail to renew agreements with the company. (Source.)

Did BRICS Really Come Out with Their Own Currency?

As the BRICS nations met this week, there were reports that they were going to introduce their own new currency, to compete with the U.S. dollar.

However, BRICS is probably nowhere near to introducing a competing currency at this point.

Rumors of BRICS Currency Launch by Putin Proven False

At the recent BRICS summit, Vladimir Putin called for an alternative international payment system, sparking discussions about de-dollarization.

However, fake news quickly spread on social media, claiming Putin had unveiled a new BRICS currency, which was not the case.

According to a report in The Guardian, the summit’s actual focus was on exploring ways to reduce reliance on the US dollar, particularly in light of its use as a political tool.

The fake news circulating over social media mentions that Putin officially unveiled a currency that could replace the dollar at the BRICS Summit. (Source.)

Kremlin spokesman Dmitry Peskov seemed to address these rumors that BRICS was introducing a new currency to replace the U.S. dollar.

BRICS not aiming to ‘defeat the dollar’ – Kremlin

The members of the economic group are not plotting against other currencies, Dmitry Peskov has said

BRICS member states are not targeting the US dollar or other currencies, Kremlin spokesman Dmitry Peskov told RIA Novosti on Tuesday. According to him, the group’s members are cooperating in pursuit of their own interests.

Peskov dismissed speculation in the Western media that the participants of this week’s BRICS Summit in Kazan intend to discuss a “plan to defeat the dollar.” An article published in The Economist on Sunday claimed that Russian President Vladimir Putin plans to “build a new global financial-payments system to attack America’s dominance of global finance and shield Russia and its pals from sanctions.”

“Cooperation within BRICS is not directed against anyone or anything – neither against the dollar nor against other currencies,” Peskov stated. “It pursues the main goal of ensuring the interests of those countries that participate in this format.” (Source.)

What Putin actually said, according to Russian media, is that it is the U.S. that uses the dollar as a “weapon” for political purposes, and that those countries who have been excluded from the Western Banking system have no choice but to develop a new one without the political drama.

US making ‘big mistake’ by weaponizing dollar – Putin

The greenback is only weakened by its politicization, the Russian president has said at the BRICS Summit

Weaponizing the US dollar is a big mistake, Russian President Vladimir Putin told a session at the BRICS Summit in Kazan on Wednesday. He made the remark following a harsh assessment on the currency’s use as a political tool by the New Development Bank’s (NDB) president, Dilma Rousseff.

According to Rousseff, the global geopolitics is being adversely affected by the use of the US dollar “as a weapon to change the living conditions of the population.”

The vast wave of sanctions against Russia have forced many Western companies from various industrial sectors including food, clothing, and car manufacturing to leave the country, and have severely restricted people’s ability to travel and make international bank transfers, she noted.

Putin agreed with Rousseff’s assessment.

”Yes, indeed, we can see that this is true. In fact, I think it is a big mistake by those who do this. The dollar remains the most important instrument of world finance and using it as a means of achieving political goals undermines confidence in this currency and reduces its capabilities,” the Russian president said.

Russia does not seek to drop the dollar or defeat it, but instead is being “prevented from working with it,” Putin added. “Then we are forced to look for other alternatives, which is what is happening.”

Many Russian financial institutions were cut off from the Western financial system in 2022 in response to Russia’s military operation in Ukraine.

As a result, Moscow has accelerated trade with international partners using their national currencies. The trend has been increasingly supported by BRICS members, which have shifted from using the dollar and euro for trade settlements. (Source.)

You can read the “BRICS Kazan Declaration” here, and there is nothing about a new “BRICS Currency” to replace the U.S. dollar.

What is reportedly in the works instead, is an entire new payment system using each country’s own local currency, probably through “stablecoins” on the blockchain, which is being referred to as the “BRICS Bridge”.

Earlier this year, the Russian Finance Ministry revealed that Russia was working on creating a settlement-and-payment infrastructure together with the central banks of BRICS member states.

The new financial system – the ‘BRICS Bridge’ platform – will be designed for settlements in national currencies and will be independent of the dominance of third parties.

The BRICS Bridge could also provide member states with the opportunity to make settlements using the digital assets of central banks linked to national currencies, Finance Minister Anton Siluanov has said.

Russia has also ramped up efforts to move away from the SWIFT system, since many of the country’s financial institutions were cut off from the Western financial network in 2022. (Source.)

“Stablecoins”, which can be linked to a nation’s currently existing currency, are completely controllable, making Central Bank Digital Currencies (CBDCs) a false flag concern, since they are not needed because existing cryptocurrencies can already provide the same dangers as CBDCs, and be completely controllable.

See:

CBDCs Not Needed – Existing Cryptocurrencies Already Programmable to Create a Worldwide Ledger for Total Surveillance and Control

Conclusion: Holding Physical Cash and Demanding its Use Prevents Central Bank Control through Digital Currencies

The biggest obstacle to putting everyone on a blockchain and requiring them to only do financial transactions through digital currencies, besides the flaws and weaknesses of the technology to even accomplish this in the first place, is the public consumer who must spend money for the economy to operate.

And if a majority of the consumers demand hard cash to make those transactions, there would be literally nothing that the Globalists could do about it.

Europeans are ahead of the curve on this issue, compared to Americans.

See:

Cash Still King: Many Germans Remain Uneasy Over Prospect of Looming Digital Euro

Citizens in Norway just forced stores to legally accept cash for payments, which began this month (October, 2024).

Starting in October, all shops in Norway will be legally required to accept cash payments up to 20,000 kroner.

So if your purpose in choosing which financial assets you should have on hand to be able to purchase local goods and services during times of emergencies, or without bank and government intrusion into your privacy about how you spend your money, CASH is still King, and CASH is Gold.

This is how we fight back against the Globalists. Stop using your credit cards when you shop in your community, and start using cash for as much as you can.

If a local store or shop doesn’t want your cash, take your business elsewhere.

Related:

Exposing the Silicon Valley Cartel Bankers’ Next Move into Digital Currencies

Comment on this article at HealthImpactNews.com.

This article was written by Human Superior Intelligence (HSI)

See Also:

Understand the Times We are Currently Living Through

New FREE eBook! Restoring the Foundation of New Testament Faith in Jesus Christ – by Brian Shilhavy

Who are God’s “Chosen People”?

KABBALAH: The Anti-Christ Religion of Satan that Controls the World Today

Christian Teaching on Sex and Marriage vs. The Actual Biblical Teaching

Exposing the Christian Zionism Cult

The Bewitching of America with the Evil Eye and the Mark of the Beast

Jesus Christ’s Opposition to the Jewish State: Lessons for Today

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

What is the Condition of Your Heart? The Superiority of the Human Heart over the Human Brain

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Image of the Beast?

Medicine: Idolatry in the Twenty First Century – 10-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.