by Brian Shilhavy

Editor, Health Impact News

A year ago (March, 2023), I reported how the GOP was coming out in public to condemn Central Bank Digital Currencies (CBDC), a sure sign that this was a psyop to get the public upset and fearful over something while the financial system was planning on implementing the principles behind CBDCs without having to use CBDCs.

Why are U.S. Politicians Suddenly Opposing CBDCs?

Within the past 30 days or so, several U.S. politicians have come out publicly against Central Bank Digital Currencies.

They include: U.S. Congressman Tom Emmer (R-MN) who has introduced a bill that would prohibit the Federal Reserve from issuing a CBDC directly to anyone, South Dakota Governor Kristi Noem who vetoed House Bill 1193, which would have amended the provisions of the Uniform Commercial Code in the state which would have included Central Bank Digital Currencies as money, Florida Governor Ron DeSantis who recently held a press conference in which he stood at a podium labeled “Big Brother’s Digital Dollar,” proclaiming that Florida shall be a CBDC-free state, and Texas Senator Ted Cruz who is reintroducing legislation to the U.S. Senate that would prohibit a direct to consumer Federal Reserve-issued CBDC.

What do these four politicians all have in common?

They are all Republicans. You know, the party that used to hold the position that “all vaccines are safe and effective and the science has been settled,” which was the position of ALL politicians, both Democrats and Republicans, until it was decided by the GOP in 2022 that it was OK to oppose one kind of “vaccine,” the COVID shots, and therefore made it a political issue.

And of course they only adopted this position AFTER hundreds of millions of Americans had already received their shots.

This GOP position on the COVID shots, however, did not result in any action to either STOP injecting Americans with COVID-19 bioweapons, nor hold accountable those who approved them.

So do we now trust them on their opposition to Central Bank CBDCs? (Full article.)

Donald Trump and Robert F. Kennedy Jr., two of the candidates running for the office of the President of the United States this year, have also made similar promises to stop the implementation of CBDCs.

Apparently they have been effective in scaring the public about the dangers of CBDCs, as earlier this month (March, 2024) Federal Reserve Chairman Jerome Powell came out in public and stated:

“People don’t need to worry about a central bank digital currency, nothing like that is remotely close to happening anytime soon.”

He made this statement to the Senate Banking Committee. (Source.)

While the U.S. public continues to be frightened about the possibilities of CBDCs, something else has been happening here in 2024, and that is the rapid advance in converting cryptocurrencies into assets, by getting the SEC to approve ETFs for existing cryptocurrencies, allowing anyone now to be able to invest in cryptocurrencies through the Stock Market without actually owning them.

Leading the way in creating cryptocurrency ETFs is Larry Fink of BlackRock, head of the largest money-management firm in the world.

To learn more about Larry Fink and BlackRock, see James Corbett’s excellent report published in September of 2023:

How BlackRock Conquered the World

BlackRock started 11 Bitcoin spot ETFs in January this year, the world’s largest cryptocurrency, and is now set to do the same for Ethereum, the world’s second most owned cryptocurrency.

BlackRock is reportedly set to “flip” its nearest competitor in Bitcoin investments in just two weeks.

BlackRock to flip $23 billion bitcoin competitor within ‘two weeks,’ analyst says

The BlackRock iShares Bitcoin Trust (IBIT) now holds more than 238,500 bitcoin valued at $15.44 billion. And surging investor interest has it on the path to exceed the $23.7 billion in assets under management of the competing Grayscale Bitcoin Trust (GBTC).

GBTC holds an estimated 368,558 bitcoin.

“BlackRock is going to flip Grayscale soon,” George Tung reported. “I say within the next two weeks, it’s going to happen.” (Full article)

So why is Larry Fink in the process of turning cryptocurrencies into assets and obtaining control of this market?

Let’s let Larry Fink himself explain it:

“We believe we’re just halfway there in the ETF revolution…Everything is going to be ETF’d…We believe this is just the beginning. ETFs are step one in the technological revolution in the financial markets. Step two is going to be the tokenization of every financial asset.” Larry Fink, 1/12/2024 on Bloomberg Television

In other words, everything the public fears from the Federal Reserve in terms of CBDCs, is already happening in the “private” sector with existing cryptocurrencies and their blockchains.

All that is needed to convert over is a “Black Swan” (Corporate Media’s term) or “False Flag” (Alternative Media’s term) event.

Tokenized, Inc: BlackRock’s Plan To Own The Fractionalized World

The new Internet Financial System: Digitizing Debt

If you want to get a picture of what is being planned for the future to save the financial system, an article published last month by Mark Goodwin, editor in chief of Bitcoin Magazine, and by Whitney Webb of Unlimited Hangout, is an excellent report that I have just finished digesting this week: Tokenized, Inc: BlackRock’s Plan To Own The Fractionalized World.

Just one day after the January 11 approval of 11 Bitcoin spot ETFs – including BlackRock’s iShares Bitcoin Trust (IBIT) – by the U.S. Securities and Exchange Commission, BlackRock Chair and CEO Larry Fink sat down with Bloomberg’s David Westin to discuss the implications of the world’s largest asset manager entering the Bitcoin market.

Not one to mince words, Fink articulated a clear framework for his company’s approach to Bitcoin, and furthermore for BlackRock’s intention to replicate similar ETF products for other assets. “If we can ‘ETF’ a Bitcoin, imagine what we can do with all financial instruments.” Fink continued, speaking about Bitcoin itself, stating “I don’t believe it’s ever going to be a currency. I believe it’s an asset class.”

Film producer James Patrick just published an interview with both Goodwin and Webb on his YouTube channel, where Webb interviews Goodwin in the first part of the video, and then Goodwin interviews Webb in the second half, in a very engaging and informative video that I encourage everyone to watch as they summarize much of what they covered in their article published in February.

As they wrote in their article, Fink wants to convert existing cryptocurrencies into assets, as opposed to using them like a “currency”.

While the BlackRock Chair was not shy about expressing other aspects of the potential build of tokenized, digital markets, these two statements in particular illuminate the coveted path forward for how the biggest institutions intend to carefully integrate Bitcoin into the legacy financial system.

Fink even went so far as to turn the abbreviated noun “ETF,” an exchange-traded fund, into a verb, gloating about transmuting the Bitcoin protocol into just another speculative commodity – all the efforts of miners and nodes across the world to decentralize trust in issuance and settlement reduced to a paper offering by their iShares division.

Many FinTech companies, such as Lightning Labs and Blockstream, have spent millions in capital developing methods for utilizing Bitcoin as a way to issue tokenized assets, such as stablecoins like Tether’s USDT, in order to transact dollar-denominated tokens via Lightning channels or federated sidechains.

While the institutional adoption dreamed of by early Bitcoin adopters has certainly come to fruition, the actualization and methods of these institutions is clear: bitcoin must remain an asset, and all effort on scaling it as a currency should be directed towards the dollar.

Fink himself in the same Bloomberg interview stated “We believe ETFs are a technology no different than Bitcoin was a technology for asset storage.”

Bitcoin Spot ETF products encourage many practices far outside the norm of the typical Bitcoin user within the near decade and a half of its existence; e.g. trusting a custodian with your keys, limiting exchange to US business days and hours, and aggregating individual exposure into a collective paper claim managed and surveilled by highly-regulated brokers.

Turning Bitcoin into an asset like this allows investment firms like BlackRock to purchase U.S. debt and hold them “off the books”. As the “Trustee” of such “assets”, U.S. Government regulators would then have the ability to seize or liquidate these “assets.”

How convenient.

The anti-State revolution that has dominated most Bitcoin discourse since 2009 has become colored by red, white, and blue ticker tape. Furthering the idea that the US has much to gain from the adoption and co-option of Bitcoin is the tangible stash of coins distributed within its borders; MicroStrategy’s 189,150 bitcoin, the 215,000 bitcoin seized by the Department of Justice, Block.one’s 164,000, Grayscale’s 487,000 in GBTC, and now the new US spot ETF offerings hold a combined 170,174 bitcoin as of 1/31.

This is inarguably a meaningful portion of the circulating supply of bitcoin, not to mention the likely possibility of further treasuries held off the books by American investors.

Bitcoin is already making US ETF inflow history, as the combined growth within the first two weeks has already outpaced the decades-long entirety of the silver spot ETF market. Any liquidity needed for an institutional Lightning Network that could compete with legacy payment providers such as Visa or MasterCard is already safely nestled within the borders of the United States, and thus well-within reach of the regulatory arms of the DoJ, SEC, Treasury, and Federal Reserve.

Within the S-1 Registration Statement filing for the iShares’ Bitcoin Trust (IBIT) application is a clause that states:

“The Trustee will dissolve the Trust if…a U.S. federal or state court or regulator, or applicable law or regulatory requirements, requires the Trust to shut down, or forces the Trust to liquidate its bitcoin, or seizes, impounds or otherwise restricts access to Trust assets;”

And if this elimination of U.S. Government debt just sounds like a “conspiracy theory,” there is recent history of such a thing already happening with BlackRock under Trump during COVID, as Trump implemented the largest “stimulus program” in U.S. history with the 2.2 $TRILLION CARES Act.

One does not have to look too far back into recent history to see the last time the United States found itself face to face with its own geopolitical crisis during the COVID-19-induced lockdown and stimulus spearheaded by the Trump administration. BlackRock was chosen by the Federal Reserve during the third week of March 2020 to manage three debt buying programs, not to mention Canada’s central bank hiring Fink’s firm to advise commercial paper purchases, nor the contract they were given by the European Union banking system to aid in sustainability.

“People like Larry Fink we’re talking to, that’s BlackRock – we have the smartest people, and they all want to do it,” Trump told reporters during a White House press appearance in which he announced the largest stimulus package in the country’s history – a $2 trillion bill.

Before entering the White House, Fink had helped manage Trump’s finances, and after a 2017 meeting with his administration, made note of his previous relationship by stating “In every meeting we had, he talked about doing more…I didn’t think ‘doing more’ meant [being] the president.”

It was no surprise then that just three years later, Trump would be employing Fink once again to manage the stimulus distribution programs alongside former majority BlackRock shareholder, Bank of America. “I do believe it’s going to continue to bring opportunities for us,” Fink stated during a 2020 earnings call, referring to government assignments.

As if predicting the coming profiteering off the unprecedented government lockdowns, in a 2011 interview with Bloomberg, Fink went so far as to say “Markets don’t like uncertainty. Markets like, actually, totalitarian governments… Democracies are very messy.” (Source.)

There is also recent history with the SEC “forcing” BlackRock to liquidate its iShares products after Russia invaded Ukraine in 2022, leaving investors with nothing.

There is recent precedent of an iShares product being liquidated after pressure from the SEC due to geopolitical advancements, specifically the Russian invasion of Ukraine.

In a press release from that same day, the iShares MSCI Russia ETF (ERUS) announced the suspension of “right of redemption of fund shares pursuant to an exemptive order issued by the [SEC]”, effective August 3, 2022, in order to “permit the fund to liquidate its portfolio.”

Two weeks after the announcement, the press release stated that “BlackRock will begin liquidating ERUS by distributing its current liquid assets to shareholders,” after removing the estimated fees associated with the liquidation and transactions.

Russian forces’ incursion into Ukraine triggered capital controls and sanctions from the consortium of related regulatory arms of the US government, which in turn restricted BlackRock – and all non-Russian investors – from participating in the Russian securities market.

The final clause of the press release communicates that due to the unknown circumstances, “there can be no assurance that shareholders would receive any liquidating distribution relating to the Russian securities and depositary receipts after the initial distribution.” (Source.)

The Universal Ledger: Tokenizing Life for Profit and Total Control of Humanity

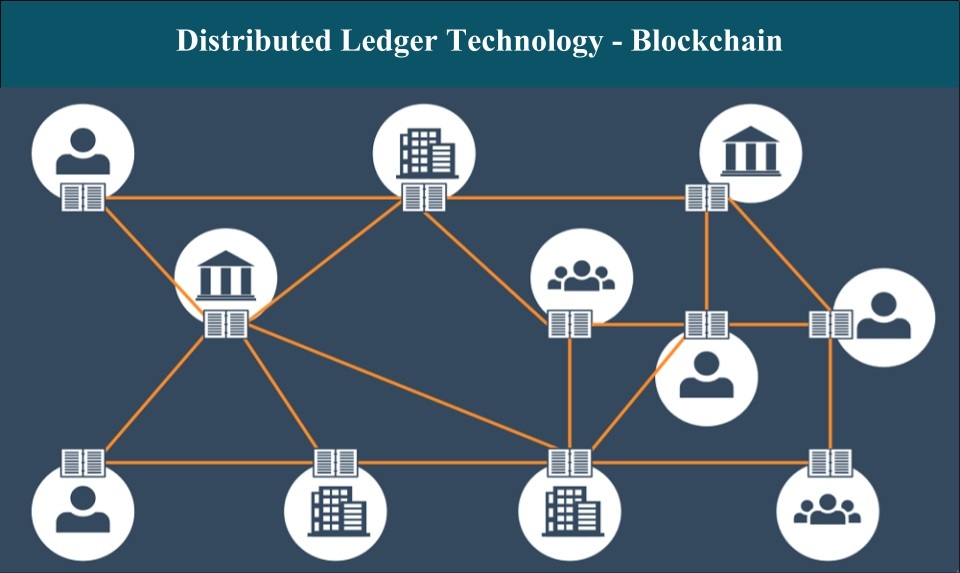

Fink and those who control the financial system want to tokenize everything in life, even nature, for profit, and put all of humanity into a “Universal Ledger”. This also fits in with the UN’s sustainable development goals, and a universal Digital ID.

THE UNIVERSAL LEDGER

Fink, in his recent statements on the coming tokenization “revolution” also emphasized how this dramatic shift would be enabled by everything that will be tokenized, as well as those interacting with the tokenized economy, having a unique identifier and having every transaction tracked “on one general ledger.” He stated specifically that:

“We believe the next step going forward will be the tokenization of all assets and that means every stock and every bond will have its own, basically, CUSIP [i.e. the system used to identify most financial products in North America]. It will be on one general ledger. Every investor, you and I, will have our own number, our own identification. We can rid ourselves of all issues around illicit activities around bonds and stocks and digital by having tokenization…. We would have instantaneous settlement. Think of all the costs of settling bonds and stocks, but if you had a tokenization, everything would be immediate because it is just a line item. We believe this is a technology transformation for financial assets. [emphasis added]”

Fink’s statements are an apparent head-nod to the UN’s sustainable development goals (SDGs, sometimes referred to as Agenda 2030), which BlackRock has long supported, both in terms of public support and in terms of pressuring companies it influences to implement SDG policy goals and tracking their progress towards their implementation. SDG 16, in particular, contains provisions for biometric and interoperable Digital IDs to be developed by the private sector that all meet the technical standards laid out by the UN-backed ID2020 (now part of the Digital Impact Alliance).

This is being done to provide the illusion of decentralization, when – in reality – these different ID systems will all be required to export data harvested from the Digital ID system to a global, interoperable database. That database is likely to be the World Bank’s ID4D.

UN documentation on the SDGs directly links Digital ID to the implementation of what it refers to as “financial inclusion.” Elsewhere, UN officials have described increasing financial inclusion as “imperative” to delivering the SDGs. As Unlimited Hangout previously reported:

The UN Task Force for the digital financing of SDGs explored how to “catalyse and recommend ways to harness digital financing to accelerate the financing of the Sustainable Development Goals.” It published a “call to action” with the objective of exploiting “digitalization in creating a citizen-centric financial system aligned to the SDGs.” The UN Task Force’s “action agenda” recommended “a new generation of global digital financing platforms with significant cross-border, spillover impacts.” According to the regime, this would, of course, require the strengthening of “inclusive international governance. Cross-border spillovers, or “externalities,” are the actions and events occurring in one country that have intended or unintended consequences in others. […] It is claimed that cross-border spillover could be managed by including “digital ID and data markets” in a system of “SDG-aligned digital financing.”

Another, related UN document, entitled “Peoples’ Money – Harnessing Digitilisation to Finance A Sustainable Future,” the UN describes how long-term financing for the SDGs and related infrastructure should come directly from the “peoples’ money,” i.e. regular people’s bank accounts, upon the implementation of “citizen-centric, SDG-aligned digital finance.”

Essential pre-requisites for this system, the document states, “includes the core digital connectivity and payments infrastructure, Digital IDs, and data markets that enable financial innovation and low-cost service delivery. [. . .] Universally-available, reliable, secure, private, unique Digital IDs are critical to enabling people to access digital finance.”

Other documents related to SDG implementation and “SDG-aligned digital finance” from entities like the Bank of International Settlements call for every business entity, from the largest to the smallest, to have “decentralized identifiers,” i.e. DIDs. In other documentation, the BIS, as well as the UN, have treated CBDCs and Digital IDs, including DIDs, as synonymous and essential to achieving the so-called “financial inclusion” agenda. Transactions of different yet interoperable CBDCs, and their private sector equivalents, are poised to be tracked on a single, global ledger, not unlike Digital ID.

In fact, it appears it is all meant to be stored on the same ledger. (Source.)

Technology’s Weakness: Why all the Plans of the Globalists are NOT a Certainty

While all of this sounds apocalyptic and inevitable, I assure you it is NOT!

What those who believe in cryptocurrency and its ability to create a decentralized financial system that Government cannot control, as well as the opposing view of Larry Fink who believes cryptocurrency can be converted into assets that give Government more control, never address, is just how frail the technology is that is supposedly going to make all of this possible.

Cryptocurrency depends upon two things to live and function: energy and a network to connect everyone.

That energy is electricity, and that network is the Internet.

If either of these two things become unstable or unavailable, the entire system collapses.

I grew up with all of this digital technology that started in the early 1980s, and use it to earn my living.

This digital technology has NEVER been stable. How often does your cell phone operating system, or computer operating system, need to be “updated” to fix bugs and protect you from hackers?

If you use any of the new AI chat bots, how often does it produce garbage that is totally incorrect?

I have been predicting since the 4th quarter of 2022 that the technology is going to crash, and that it is not sustainable.

Start reducing your dependency on the technology now, before it boomerang’s back to destroy you.

Invest in REAL assets, hard assets that you own and control, and are not dependent upon the new digital technology that has only existed since the 1980s for the most part. This world has functioned and survived long before then.

And if you hold real assets that are leveraged through debt, such as a bank-funded mortgage on your home, you don’t really “hold” that asset, because you are leveraged by debt, and you can quickly lose it when the system crashes.

If you hold physical precious metals such as gold and silver, fine, but how are you going to convert that into purchasing power when the system goes down?

Even today, go try and sell your gold and silver hard assets right now, legally, without the Government knowing about it. Almost everyone you try to sell it to and convert to cash, will tell you that they have to report it to the IRS if it exceeds a certain amount, and the laws are constantly changing.

How hard do you think it will be for the Government to make it harder, or even illegal to liquidate your precious metals, as it was for nearly 4 decades between Roosevelt and Nixon when it was illegal to own Gold Bullion?

At least have a short-term plan to survive any major event in your area should disaster strike. If you have lived through natural weather disasters in the past such as hurricanes or tornadoes, you know how quickly the store shelves can go bare.

Think of what happened in 2020 when Trump locked down the nation due to COVID, and which items quickly disappeared from the stores, and be better prepared this time.

If these Satanic Globalists try to actually pull off something like this with digital currencies, there will be economic opportunities for those who resist, as alternative economical systems will start, and even proliferate, depending upon how much of the population resists.

Don’t let yourself become a victim. Prepare now to be a leader in your community offering hope and guidance when the time comes, and start learning NOW how to live without the technology.

Rich and poor have this in common: The LORD is the Maker of them all. A prudent man sees danger and takes refuge, but the simple keep going and suffer for it. (Proverbs 22:2-3)

Related:

Healthy Traditions Offers Up to a 20% Return on a $1000 Investment and Up to a 30% Return for $5000 Investment to Become Resellers of Long-term Storable Food Tested for GMOs and other Toxins

Comment on this article at HealthImpactNews.com.

This article was written by Human Superior Intelligence (HSI)

See Also:

Understand the Times We are Currently Living Through

New FREE eBook! Restoring the Foundation of New Testament Faith in Jesus Christ – by Brian Shilhavy

Who are God’s “Chosen People”?

KABBALAH: The Anti-Christ Religion of Satan that Controls the World Today

Christian Teaching on Sex and Marriage vs. The Actual Biblical Teaching

Exposing the Christian Zionism Cult

The Bewitching of America with the Evil Eye and the Mark of the Beast

Jesus Christ’s Opposition to the Jewish State: Lessons for Today

Identifying the Luciferian Globalists Implementing the New World Order – Who are the “Jews”?

The Brain Myth: Your Intellect and Thoughts Originate in Your Heart, Not Your Brain

What is the Condition of Your Heart? The Superiority of the Human Heart over the Human Brain

The Seal and Mark of God is Far More Important than the “Mark of the Beast” – Are You Prepared for What’s Coming?

The Satanic Roots to Modern Medicine – The Image of the Beast?

Medicine: Idolatry in the Twenty First Century – 10-Year-Old Article More Relevant Today than the Day it was Written

Having problems receiving our emails? See:

How to Beat Internet Censorship and Create Your Own Newsfeed

We Are Now on Telegram. Video channels at Bitchute, and Odysee.

If our website is seized and shut down, find us on Telegram, as well as Bitchute and Odysee for further instructions about where to find us.

If you use the TOR Onion browser, here are the links and corresponding URLs to use in the TOR browser to find us on the Dark Web: Health Impact News, Vaccine Impact, Medical Kidnap, Created4Health, CoconutOil.com.